Our goal is to communicate the real estate process every step of the way to ensure our clients have all of the pertinent information to make the best decision for them! If you’re looking to buy or sell, our in-depth knowledge of the market will help you navigate the current market!

BANK OF CANADA INCREASES POLICY INTEREST RATE BY 50 BASIS POINTS, CONTINUES QUANTITATIVE TIGHTENING

The Bank of Canada increased its target for the overnight rate to 4¼%, with the Bank Rate at 4½% and the deposit rate at 4¼%. The Bank is also continuing its policy of quantitative tightening.

Inflation around the world remains high and broadly based. Global economic growth is slowing, although it is proving more resilient than was expected at the time of the October Monetary Policy Report (MPR). In the United States, the economy is weakening but consumption continues to be solid and the labour market remains overheated. The gradual easing of global supply bottlenecks continues, although further progress could be disrupted by geopolitical events.

In Canada, GDP growth in the third quarter was stronger than expected, and the economy continued to operate in excess demand. Canada’s labour market remains tight, with unemployment near historic lows. While commodity exports have been strong, there is growing evidence that tighter monetary policy is restraining domestic demand: consumption moderated in the third quarter, and housing market activity continues to decline. Overall, the data since the October MPR support the Bank’s outlook that growth will essentially stall through the end of this year and the first half of next year.

CPI inflation remained at 6.9% in October, with many of the goods and services Canadians regularly buy showing large price increases. Measures of core inflation remain around 5%. Three-month rates of change in core inflation have come down, an early indicator that price pressures may be losing momentum. However, inflation is still too high and short-term inflation expectations remain elevated. The longer that consumers and businesses expect inflation to be above the target, the greater the risk that elevated inflation becomes entrenched.

Looking ahead, Governing Council will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target. Governing Council continues to assess how tighter monetary policy is working to slow demand, how supply challenges are resolving, and how inflation and inflation expectations are responding. Quantitative tightening is complementing increases in the policy rate. We are resolute in our commitment to achieving the 2% inflation target and restoring price stability for Canadians.

WHAT YOU NEED TO KNOW ABOUT “TRIGGER RATES”

MORTGAGE UPDATE FROM JULIE ISAAC

There’s been a great deal of talk in the media lately about variable-rate mortgage borrowers hitting their so-called “trigger rate.”

Below, I’m going to explain what that trigger rate is, the preemptive steps if you are a variable-rate mortgage borrower you can take, as well as options if you have already reached that point.

What is a “trigger rate?”

It’s important to know this term applies specifically to those with a variable-rate mortgage that has fixed monthly payments.

In a rapidly rising rate environment, such as the one we’ve experienced this year, the trigger rate is reached when your entire mortgage payment is going towards the interest cost, with none going towards reducing your outstanding balance.

Those with an adjustable-rate mortgage, whose payments fluctuate as interest rates rise and fall, and those with a fixed-rate mortgage have no risk of this happening during the course of their term.

Why is it a big deal now?

The reason you’re hearing so much about trigger rates these days is because so many borrowers opted for variable rates when rates were at record lows during the pandemic.

Early this year, roughly half of all new mortgage borrowers were choosing variable rates. That means variable-rate mortgages now account for about one-third of all outstanding mortgages in Canada, up from about 20% in 2019.

The Bank of Canada estimates that roughly three-quarters of variable-rate mortgages have fixed payments.

And of those, about half have already reached their trigger rate thanks to the historic 350-basis-point rise in the prime rate in just nine months.

What steps can you take?

If you currently have a variable-rate mortgage with fixed monthly payments, you’ve no doubt seen the portion of your payments going towards the interest cost surge.

Rather than wait until you reach the point where none of your payment is reducing your principal balance, you should pre-emptively contact your lender to clarify your options.

If you have the ability, increasing your payment amount immediately will keep you ahead of the game and ensure a larger amount is going towards reducing your principal. This also applies to borrowers who may have reached their trigger rate and have already had to increase payments, since we’re expecting at least another rate hike or two from the Bank of Canada in the coming months.

Some lenders will allow you to extend your amortization or even have negative principal payments, but that may result in a significant payment increase at renewal time.

If you’d like to learn more, please don’t hesitate to let us know. We’d be happy to connect you with Julie Isaac, a trusted Mortgage Broker that we refer our clients to.

…contact us to connect with Julie Isaacs

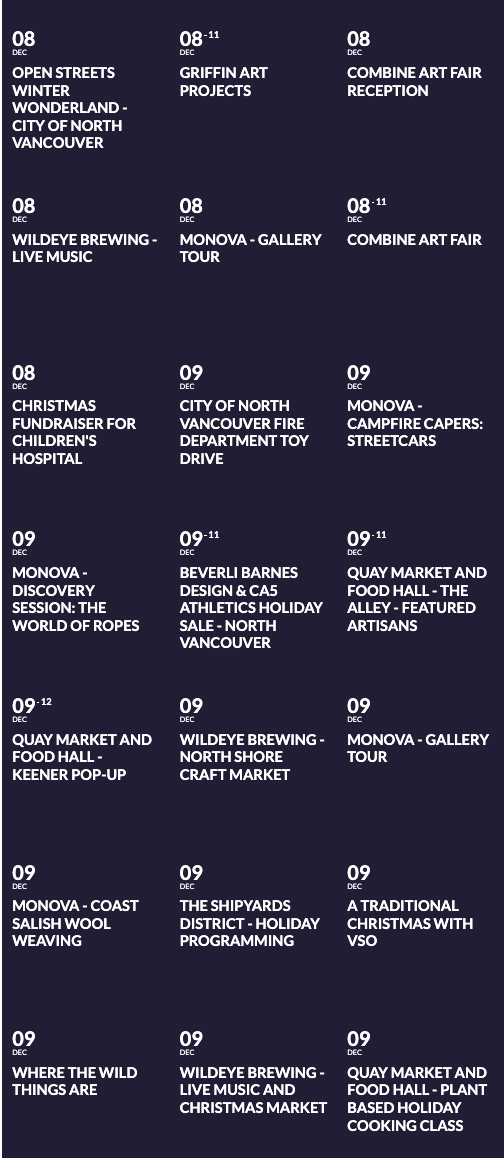

NORTH SHORE EVENTS CALENDAR

| VIEW THE CALENDAR |

Join us!

Saturday, December 19th: Family Fun in Dundarave 1pm – 4pm

The Ambleside Dundarave business improvement association is hosting this family fun afternoon which encourages families to bring the kids out for an afternoon of carollers singing Christmas songs, face painting, sales and specials from the businesses and a visit from The Grinch.

| CONTACT US TO LEARN MORE |